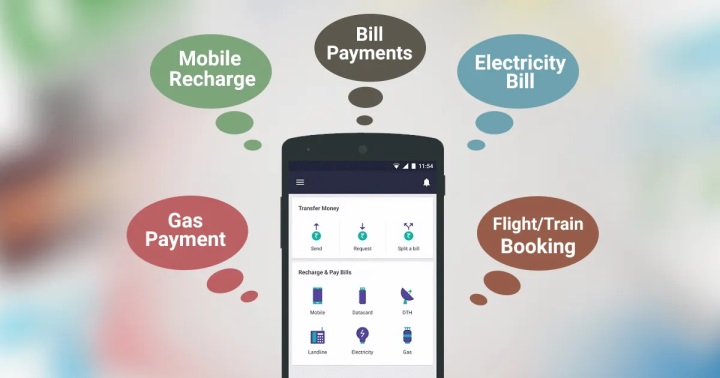

It’s 2024! The digitalisation in each and every sphere is increasing with each day passing by. Managing our finances has become more seamless than ever, thanks to the endless online tools at our disposal, literally just a tap away, even property tax online payment! One of the top components of personal finance management is paying bills, and with the rise of online bill payment applications, the overall transaction process has become much more convenient and efficient.

Long gone are the days when people actually used to visit nearby shops for bill payments. Now, they pick up their smartphone, go on the right platform, and they are good to go.

The Rising Trend of Online Bill Payments

Especially after the COVID-19 outbreak, the trend of online payments has witnessed a significant upsurge for apparent reasons. It offers unparalleled convenience, efficiency and safe payments with just a few taps on your smartphone.

Gone are the days when people used to write checks and rely on postal services to ensure timely essential payments. Fast-forward even till 2020, before the Covid-era, UPI or online payments didn’t witness much growth due to the easy flow of cash. Post this, UPI has been the need of the hour for almost every single person and in the future, tap payments will also witness attention.

However, there are several prime reasons that can be attributed to the popularity of online bill payments. First and foremost, they offer an instant and safe method of managing finances, eliminating the need for manual processes and reducing the risk of late payments.

Secondly, the integration of mobile applications and easy-to-use interfaces has made the overall payment process as simple as ordering food from your smartphone. For example, I complete my airtel bill payment in literally 10 seconds.

Beyond the immediate benefits of convenience, security and safety, the overall shift towards online bill payments aligns with a broader commitment to environmental sustainability. By reducing the reliance on physical paper, these payments undoubtedly contribute to a significant decrease in paper waste.

Top Online Bill Payment Apps in 2024

- Bajaj Finserv

If you are planning to go digital, Bajaj Finserv is one of the top applications. Believe me, I’ve been using this application for over two years now, and its easy interface just makes it too easy to operate. Moreover, from online electricity bill payment to credit card payments to even availing loan facilities, you name it, this application has it.

- PhonePe

Another application is PhonePe. It is also easy to use and offers a lot of financial tools. It was founded back in 2015 and has transformed in many ways since then.

- Google Pay

This is another platform that is quite trending. It is convenient to use and has a very simple interface. However, unlike Bajaj Finserv, it doesn’t have many financial tools.

Conclusion

This year, the landscape of online payment applications will undoubtedly witness a lot of remarkable advancements. After a comprehensive and detailed understanding, it becomes evident that each app caters to specific user preferences and needs. Bajaj Finserv stands out for its seamless integration of UPI technology, offering swift and secure transactions.